Content

This is assuming that the investment would make regular payments to repay the money. While you know up front you’ll save a lot of money by purchasing a building, you’ll also want to know how long it will take to recoup your initial investment. That’s what the payback period calculation shows, adding up your yearly savings until the $400,000 investment has been recouped.

Payback is used measured in terms of years and months, though any period could be used depending on the life of the project (e.g. weeks, months). In simple words, depreciation means reducing the value of any goods or asset with time, and it is typically measured in percentage. Depreciation is an essential factor to consider while accounting and forecasting for any business. Thus, it fails to see the long-term potential of the business because the focus is only on the short-term ROI. However, the payback period can also be more comprehensive than its mark when the organization is likely to experience a growth spurt soon. Most broadly speaking, a good payback period is the shortest payback period possible.

What is the difference between the payback period and the discounted payback period?

Time value of money (TVM) is the principle that an amount of money at a current point in time will be worth more at some point in the future. This is because of its budding earning potential (due to interest that can be earned the quicker it is received). Go a level deeper with us and investigate the potential impacts of climate change on investments like your retirement account. These formulas account for irregular payments, which are likely to occur.

- But in the case of unequal cash inflows the PB period can be found out by adding up the cash inflows until the total is equal to initial cash outlay.

- The discounted payback period determines the payback period using the time value of money.

- Simply put, it is the length of time an investment reaches a breakeven point.

- So also factor in MRR, churn, and CLTV in coming up with the perfect channel mix.

- Increasing your prices is not the only way to make more revenue from customers.

- With a discount rate of 10{3701e4e01477974df85d03acecbd225490ddfe9cb0616ec594651c979a691120}, for example, a dollar today will be worth ninety cents next year.

If we divide $1 million by $250,000, we arrive at a payback period of four years for this investment. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. When trying to estimate whether or not a new investment is financially viable, you should have a discount rate in mind.

Product

In other words, it is the period of time at the end of which a machine, facility, or other investment has produced sufficient net revenue to recover its investment costs. The term is also widely used in other types of investment areas, often with respect to energy efficiency technologies, maintenance, upgrades, or other changes. For example, a compact fluorescent light bulb may be described as having a payback period of a certain number of years or operating hours, assuming certain costs. If opening the new stores amounts to an initial investment of $400,000 and the expected cash flows from the stores would be $200,000 each year, then the period would be 2 years. The discounted payback period determines the payback period using the time value of money. As the project’s money is not earning interest, you look at its cash flow after the amount of money it would have earned from interest.

Since IRR does not take risk into account, it should be looked at in conjunction with the payback period to determine which project is most attractive. As an alternative to looking at how quickly an investment is paid back, and given the drawback outline above, it may be better for firms to look at the internal rate of return (IRR) when comparing What Does My Accountant Need To File Business Taxes? projects. Where c is the capital cost ($), s is the saving ($) during the first year of the solar dryer, d is the interest rate on long-term investments, and i is the inflation rate. Where r is the annual interest rate, e is the annual inflation rate for the price of energy, and n is the number of years for calculating the cumulative savings.

How do you calculate the discounted payback period?

Companies that fail to recognize this potential are at risk of missing out on essential business prospects. Moreover, it helps to recognize which product or project is the most efficient to regain the investment at the earliest possible. There are some https://simple-accounting.org/bookkeeping-for-llc-best-practices-and-faqs/ clear advantages and disadvantages of payback period calculations. (8.46), as mentioned by several authors in (Sreekumar, 2010; Sreekumar, Manikantan, & Vijayakumar, 2008). (8.3)–(8.5) are preferred approaches to finding the payback time than Eqs.

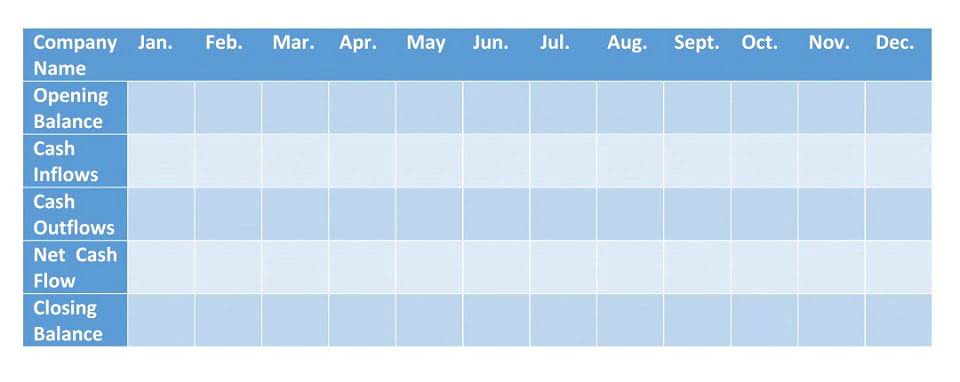

Last but not least, there is a payback rule called the payback period, which calculates the time required to recover the investment cost. Cash flow is the inflow and outflow of cash or cash-equivalents of a project, an individual, an organization, or other entities. Positive cash flow that occurs during a period, such as revenue or accounts receivable means an increase in liquid assets.

Why use the payback period?

8.9, can be made to calculate the payback period, referring to different known values of r, m, i, and e. However, if the values of the parameters are different from the values mentioned in the diagram, one then needs to estimate the payback time using Eqs. The sum of investment (I) can be calculated considering the initial investment cost (C) with interest and the number of operating years (n). Payback period is often used as an analysis tool because it is easy to apply and easy to understand for most individuals, regardless of academic training or field of endeavor. When used carefully or to compare similar investments, it can be quite useful.

- One way corporate financial analysts do this is with the payback period.

- The sum of investment (I) can be calculated considering the initial investment cost (C) with interest and the number of operating years (n).

- Discounted cash flow is a valuation method used to calculate future cash flows from a particular investment.

- They might assume that the net cash inflow is constant each year to calculate the payback period formula.